Coming Soon

Transcript

Grade Me: Final Project Treatment

- Approximate Length: 10 minutes

- Audience: The intended audience of this piece is people who have heard about this topic on the news but haven't looked into what happened.

- Objectives: The audience will understand the timeline of what happened with GameStop and receive and overview of why people believe what they believe. Special focus will be spent on what's called "DD", for "Due Diligence", as well as who writes it, and how people react to it. The intent is to provide enough information that a casual viewer will be able to assess the accuracy of this information later, after the situation is resolved.

-

Background

-

Keith Gill

- Original Analysis

- Reddit Account

- Keith Gill's Wiki

-

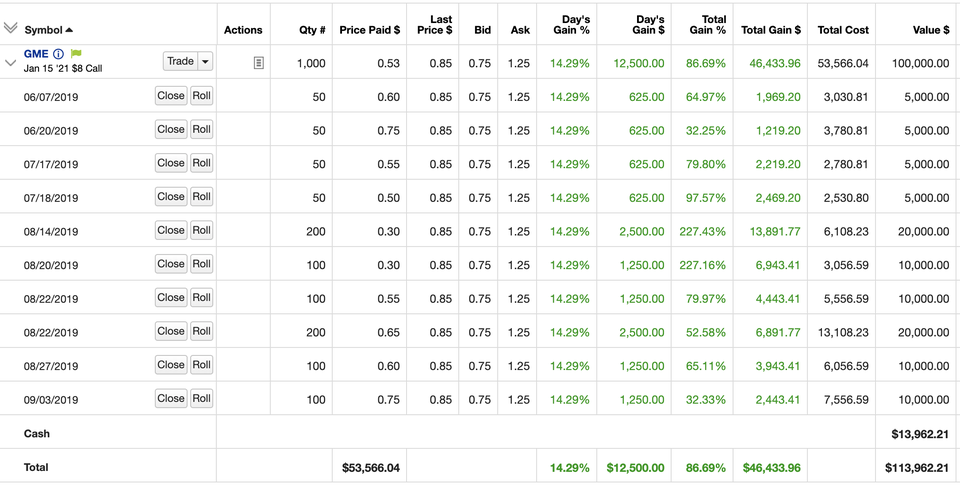

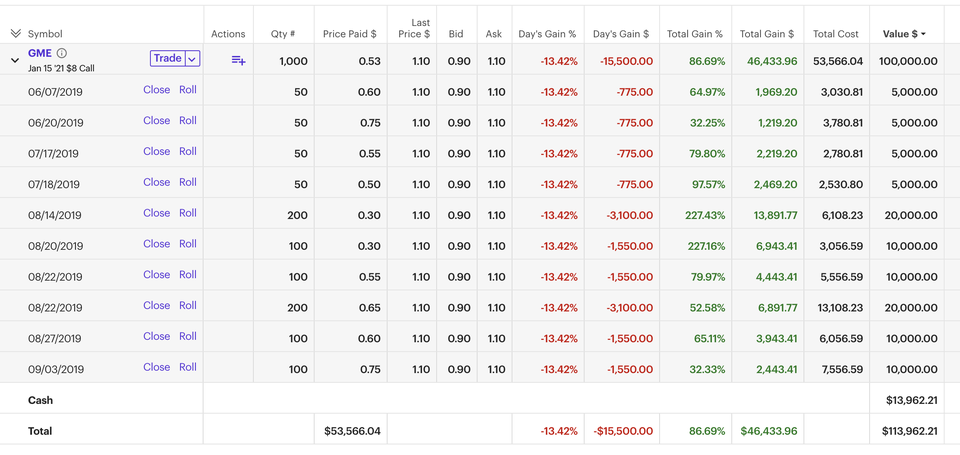

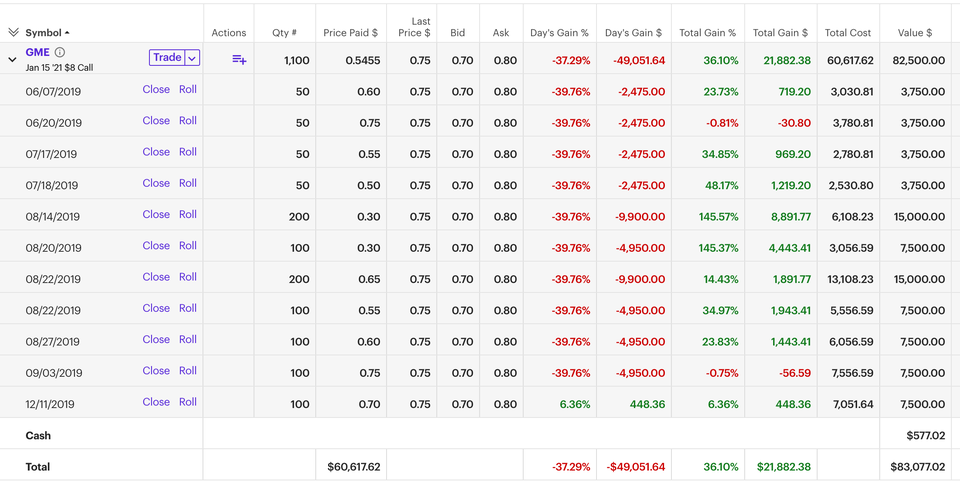

Much of understanding the saga of Gamestop comes from recognizing the guy who discovered and first reported it. Keith Gill identified what he believed were abusive market manipulation tactics in GameStop as early as 2019. His initial reported purchase of GME in large blocks was in June of 2019. Keith spent over a year explaining why he made the decisions he made in an online forum on the service Reddit called WallStreetBets. He took tons of abuse from others decrying the death of brick and mortar stores, but wasn't deterred. Instead, he explained for hours every day on YouTube the financial aspects driving his decision. Keith posted what WSB called a "YOLO", or a position demonstrating that because You Only Live Once, you have decided to place large amounts of money into a single position. Between June and September of 2019, Keith "bet" 53,566.04 that by January 15th, 2021, GameStop would be above $8.

Keith Gill held his position despite earnings reports described as a "Chernobyl experience" and a "nightmare". After the nightmare Q3 report, he lost 49,051.64 in value on a single day, and choose to purchase another $7k in calls.

Over a year later, Keith Gill explained that short interest in Gamestop had reached over 100%. This means for every share of GameStop that was sold, at least two shares actually existed, on YouTube in July of 2020.

Keith Gill continued to post monthly updates on his YOLO position for the next two years, while discussing his views and strategy frequently on YouTube. The basic premise Keith supported is that GameStop was fundamentally mismanaged at the corporate level, but that the brand and stores actually had the potential for great profitability.

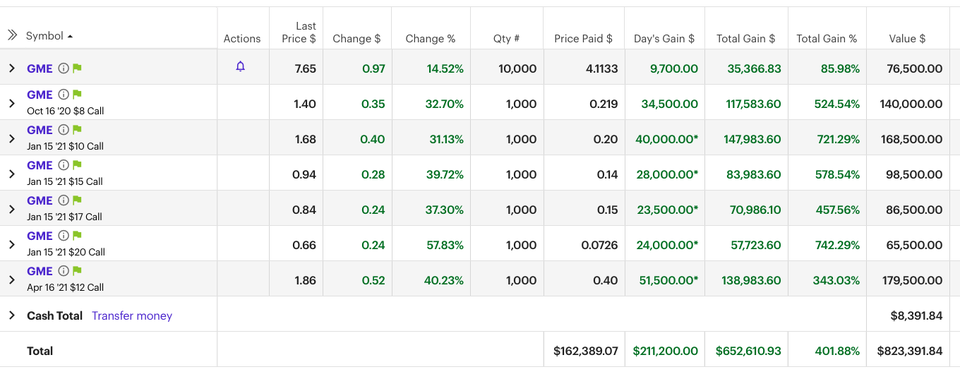

In September, 2020, Keith Gill's YOLO had grown to $162,389.07 invested with a return value of $652,610.93. Then things got interesting.

Keith Gill, and the reddit movement, was often referred to "ignorant investors" or "dumb money" in articles and online opinion pieces, but Keith Gill was a licensed securities broker and Chartered financial Analyst charter holder. He worked from 2010 to 2014 developing software to analyze stocks, and worked as a registered financial broker until his resignation during the events of January, 2021.

Ryan Cohen

At the end of August, 2020, Ryan Cohen filed a 13D with the SEC announcing he'd aquired a significant stake in GameStop. He purchased 2,784,560 shares during August, which added to the 2,050,047 he had purchased prior. Ryan Cohen is the founder of an online e-commerce platform for pets called Chewy. Chewy was reknown for it's customer relations, and was sold to Petsmart for 3.3 billion dollars in 2017.

Cohen sent an open letter to the Board of GameStop in November, outline his plan to transform the company into an aggressive e-commerce competitor. The Wall Street Journal reported Cohen was offered a board seat and declined, saying he didn't intend to be the only shareholder advocate on the board.

The Hon Gary Gensler

New SEC Chairman. Gary Gensler testified to the House as part of the investigation into the GameStop spike. During these hearings, the Hon. Gary Gensler testified repeatedly that the SEC was not concerned about collaboration among what he termed “First Amendment communities” and was instead concerned about protecting retail investors from manipulation by large corporations, specifically calling out computerized AI programs and paid interactions as troublesome. He also testified that payment for order flow was intrinsically harmful to retail in the cases investigated, that he believed there was pressure on the retail community to go into crypto so that bad actors could avoid regulation, and that leverage and margin were getting to extreme levels, and that he’d know a lot more about all of this if it wasn’t his third week on the job.

January

January is when the general public became aware of the GameStop situation. News articles appeared mentioning GameStop by name, but also associating with a basket of other stocks which came to be known as "meme stocks". This is when the story gets interesting, because millions of people jumped in, many of them first time investors. The price of GameStop started rising, when suddenly RobinHood, a trading application designed for and primarily used by small retail investors, halted trading in GME, AMC, and a few other stocks. With trading halted, the price of these stocks fell sharply. RobinHood reported a change in margin requirements forced them to halt buying in order to raise funds. RobinHood received a large cash infusion from its parent company, and was able to resume trading. While RobinHood blocked buying, but not selling, the price fell. It recovered somewhat when trading resumed, but then plunged deeply, from a high of 483 to a low eventually of 38.50.

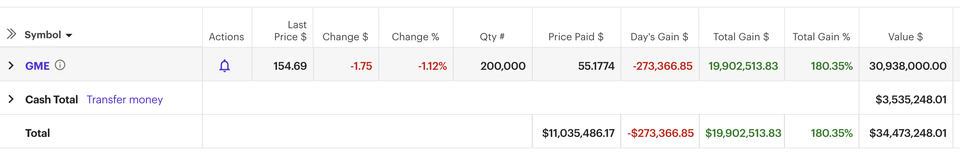

Keith Gill posts a YOLO update showing unrealized gains of forty six million dollars, and does not sell

Immediately after the spike, the short interest calculations were announced saying that the short positions in GME had covered. Investors on Reddit disagreed, set about proving their hypothesese. The platform RobinHood was abandonned in droves, with one it's primary competitors, Fidelity, reporting 4.1 million new users during this timeframe.

On Reddit, the narrative became that only some short positions had been managed to be closed out, initially based on the logic that shorts simply couldn't have purchased enough shares while the general public was also FOMOing in. Divisions began to grow between new and old investors, with the WallStreetBets forum itself gaining 2 million members in a single day, with many of them agitators and dissenting opinions. S3 Partners initially claims on Jan 29th that shorts were not covering their positions, teases a special announcement press conference, and then cancels it saying changing data indicated the shorts actually had covered their positions after all. Meanwhile, brokerages report GME one of the most purchased stocks during this time. GME and other meme stocks experience extreme volatility, and often react differently than one might expect. Ryan Cohen began to exert influences over the board of directors. GameStop makes changes to their order fullfillment, including same day delivery through delivery services. Moderators were accused of selling out to financial groups, including selling the film rights, and upheaval lead to two seperate instances of subforum migration. The first to r/GME, followed soon after by a migration to r/SuperStonk. The group set about researching, analyzing, and essentially breaking down the stock market en masse, while discussing the company and it's fundamentals. The group rallied around the store itself, making intentional purchases.

At the end of February, the price spiked again, then again in the beginning of March. On March 10th, while Redditors watched and chatted in a daily chatroom, the price of GME plunged 48% in 23 minutes, falling from $348 to $172. MarketWatch may or may not have published information related to the crash prior to it occuring. They edited a story with details through the day, with many traders reporting they'd seen a version describing the crash prior to it occuring by fifteen minutes. The price climbed back up the next day, but to a lower high, eventually reaching $295 before it began a pattern of oscillation that redditors affectionally referred to as "Sideways trading" even though it could vary as much as $40. GameStop remained in a pattern redditors termed, "The Mother of All Wedges".

The reddit crowd discussed the available data to an extent rarely seen before. They started peer reviewing their data and bringing in experts in the field. Initially, reaching out to experts in the form of "AMAs" a reddit tradition of an informal interview where you may "Ask me Anything." The subforum SuperStonk brought in experts in high frequency trading, short selling, finance fraud, and voter protections. Redditors developed a theory to explain why short interest had appeared to drop to low levels, while still explaining the buying pressure on GME. By collecting and sharing reports, redditors put together documents which they reviewed publically and edited extensively. Eventually, redditors began to be convinced they knew what had happened.

Cohen set about fixing the company, until April 8th, when he was announced as future Chairman of the board. Reddit user ButtFarm69 photoshopped Cohen's face onto a chair with a glass of whiskey, and SuperStonk collectively lost their minds when Cohen tweeted the same picture with the caption "No Filter" a few hours later.

Reddit users had identified a pattern within GME's stock movement. Referred to a T+35, it refers to the requirement that a stock which has been borrowed and not delivered must be delivered within 35 days or be reported. Reddit data indicated these fails were being hidden in such a way that they were renewed in a periodic manner. There was, however, an anomoly in the data, as one of the cycles had been predicted to hit around the same time GameStop had announced Cohen. The next heavy pressure day was predicted for May 24th and 25th, which was also the day the stock reached the end of the "Mother of all Wedges". During this time, GameStop climbed from near $180 to $274, before touching $294 again on June 1.

Tweets That Made People Lose Their Minds

-

- Content with Production Details: Much of the content of this story is being told through the perspective of what happened on the internet. I've been gathering images and video to help tell story through various reports and public events. I'm still deciding how to handle news footage. I will also be recording footage for "stage setting", and recording some interviews via ZOOM.

- Questions:

-

Style: This will be a mix of poetic mood setting, with a primarily Expository with explanations of events, and video and images related to those events.

-

Interviews: I'm going to essentially interview myself, my little sister, and a few volunteers from Reddit.

-

Inspiration Pieces: I am looking for the realism and production value of Hotel U.S.A.: Refugees Spend Their First Night in America | Op-Docs with the gritty realness and editorial feel of Atencion!